Labels

- conn (1)

- FHA (1)

- Flea (1)

- HAMP (1)

- homes (1)

- HUD (1)

- kate hepburn (1)

- Malibu (1)

- Palm Springs (1)

- real estate agents (1)

- redhot chili peppers (1)

- Seaside Heights (1)

- Sinatra (1)

- Yacht island (1)

Saturday, May 26, 2012

Friday, May 25, 2012

Saturday, January 28, 2012

HUD homes

There's a HUD house around the corner from me, and frankly, that's the first one I've ever seen. Its a bomb, of course, as in you huff and you puff and you can blow the house down, but still, I wanted to know the price, and the terms, and the qualifications. Do you think anybody bothered to return my call?

To be continued....

Homeowner assistance program is expanded

By BLOOMBERG NEWS

Saturday, January 28, 2012

The Obama administration, seeking to help more homeowners lower their interest rates and shed mortgage debt, will relax the rules on a federal loan-modification program and triple its incentives to banks.

The revised Home Affordable Modification Program, or HAMP, also would pay Fannie Mae and Freddie Mac to forgive debt on homes that have lost value. The government-owned companies, citing cost, don’t reduce principal, a policy that has limited HAMP’s reach because they own or guarantee nearly half of U.S. home loans. About 900,000 borrowers have successfully used the lifeline to refinance, fewer than the 4 million borrowers HAMP — which pays mortgage servicers and investors for successfully modifying loans — was expected to reach.

Friday’s program changes are separate from a new refinancing plan that President Barack Obama promised to deliver in his State of the Union speech Tuesday.

Whether Fannie Mae and Freddie Mac accept the administration offer is up to Edward DeMarco, acting director of the Federal Housing Finance Agency, which is charged with minimizing losses to the companies and to taxpayers. DeMarco said he would analyze the potential costs and benefits of participating in HAMP’s principal write-down effort.

The HAMP expansion, called HAMP Tier 2, triples incentives paid to banks that reduce mortgage principal, to a maximum of 63 cents for every dollar of debt forgiven. Investors who rent out their properties would be eligible to refinance under the new rules. The deadline for applying for a HAMP loan modification is extended for a year, to the end of 2013.

The revised Home Affordable Modification Program, or HAMP, also would pay Fannie Mae and Freddie Mac to forgive debt on homes that have lost value. The government-owned companies, citing cost, don’t reduce principal, a policy that has limited HAMP’s reach because they own or guarantee nearly half of U.S. home loans. About 900,000 borrowers have successfully used the lifeline to refinance, fewer than the 4 million borrowers HAMP — which pays mortgage servicers and investors for successfully modifying loans — was expected to reach.

Friday’s program changes are separate from a new refinancing plan that President Barack Obama promised to deliver in his State of the Union speech Tuesday.

Whether Fannie Mae and Freddie Mac accept the administration offer is up to Edward DeMarco, acting director of the Federal Housing Finance Agency, which is charged with minimizing losses to the companies and to taxpayers. DeMarco said he would analyze the potential costs and benefits of participating in HAMP’s principal write-down effort.

The HAMP expansion, called HAMP Tier 2, triples incentives paid to banks that reduce mortgage principal, to a maximum of 63 cents for every dollar of debt forgiven. Investors who rent out their properties would be eligible to refinance under the new rules. The deadline for applying for a HAMP loan modification is extended for a year, to the end of 2013.

Thursday, January 26, 2012

http://inhabitat.com/artist-victor-moore-builds-an-incredible-junk-castle-for-just-500/junk-castle/?extend=1

Perched atop a defunct rock quarry in Washington state, the "Junk Castle" is an ornate abode that was built completely out of salvaged materials for just $500. Created by high school teacher, writer and artist Victor Moore for his 1970 MFA thesis assemblage sculpture, the castle is made from pieces found at a local junkyard and around the site itself. Read on for a closer look at this fascinating recycled building!

Friday, January 20, 2012

Home sweet underwater home...

A cliff-top casita

4 of 7

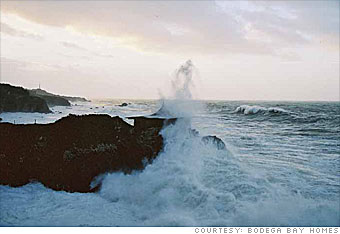

Timber Cove, Calif.

Price: $1.995 million

Bedrooms: 1

Baths: 1

Square feet: 1,200

This is one of the most expensive 1,200 square-foot homes you'll ever find. The price tag is mainly due to its perch high on a promontory on the rugged Sonoma County coast.

The home is surrounded on three sides by crashing surf. And when the big rollers come in, the spray from breaking waves can wash over the roof of the house, more than 75 feet above the sea. The sturdy steel, stone, redwood and plexi-glass building has been securely anchored to solid rock, however.

The windowed walls give the rooms panoramic ocean views and the spire roof is practically all glass, flooding the interior with light. There's a stone fireplace, a dining area next to a glass wall, a wooden deck and a redwood hot tub.

The house sits on three acres of land and is accessed via a boardwalk. It's about two hours north of San Francisco and an hour or so from some great wine country.

For further information: Trulia

Friday, January 13, 2012

Mitt's Crib in La Hoya...

GOP cribs: Where the candidates live

It may not be 1600 Pennsylvania Ave., but the presidential candidates reside in some pretty nice digs. Here's a look at where they live -- at least, for now.

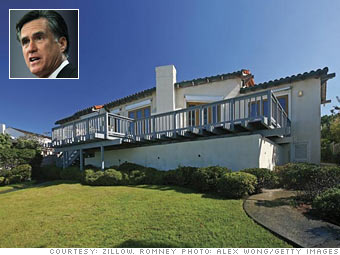

Mitt Romney

1 of 6

Location: La Jolla, Calif.

Estimated value: $9.6 million

Out of all of the candidates, former Massachusetts Gov. Mitt Romney owns the most real estate, including a townhouse in Boston and this beachfront home in La Jolla, Calif.

Romney bought the home in May, 2008 for $12 million, according to public records. Now, he is planning a massive overhaul of the place.

The Spanish-style home is on a cul-de-sac with direct access to the beach. There are plenty of luxury features like a secluded patio with a lap pool, spa and a chef's kitchen.

Zillow currently values the home at $9.6 million, but that's about to change. Romney has filed an application with the city to tear down the 3,000-square-foot, single-story property and build a more than 8,000-square-foot, three-story home, according to the city of San Diego's development services department.Tuesday, November 1, 2011

Subscribe to:

Posts (Atom)